Case Journeys

Exploring intriguing stories and insights from around the world.

The Insurance Olympics: Which Policy Takes Home Gold?

Discover which insurance policy wins the gold! Uncover contenders, benefits, and tips to choose the ultimate coverage for your needs.

The Ultimate Showdown: Comparing Homeowners, Renters, and Auto Insurance

When it comes to insurance, homeowners, renters, and auto policies each serve distinct purposes and cater to different needs. Homeowners insurance not only protects the physical structure of your home but also covers personal property and liability issues. In contrast, renters insurance is designed for those who lease their homes, covering personal belongings and providing liability protection, but it does not extend to the dwelling itself. For a detailed comparison of these types of policies, see this Policygenius article. On the other hand, auto insurance safeguards your vehicle against damage, theft, and liability claims arising from accidents, offering various coverage options tailored to individual circumstances.

Understanding the differences in coverage can help consumers make informed decisions.

- Homeowners Insurance: Comprehensive protection for both home and belongings.

- Renters Insurance: Focuses on personal property, usually at a lower cost.

- Auto Insurance: Mandated in most states, protects against vehicle-related risks.

Gold Medal Coverage: What to Look for in a Life Insurance Policy

When searching for a life insurance policy, it's crucial to look for coverage that meets your specific needs. Gold medal coverage should not only provide a safety net for your loved ones but also offer peace of mind through reliable benefits. Start by assessing the type of life insurance that suits you best—whether it's term life or whole life insurance. According to Investopedia, understanding the distinction between these policies is essential, as it influences your long-term financial strategy.

In addition to policy type, consider the coverage amount and premium costs. It's advisable to compute how much life insurance you would need to cover debts, children’s education, and daily living expenses. A helpful rule of thumb is to aim for coverage that is 10-15 times your annual income. Furthermore, make sure to review the insurer's financial strength and customer reviews to ensure they're trustworthy. Resources like J.D. Power provide insights into customer satisfaction that can guide your choice in selecting the right policy.

The Insurance Olympics: Which Policy Offers the Best Value for Your Money?

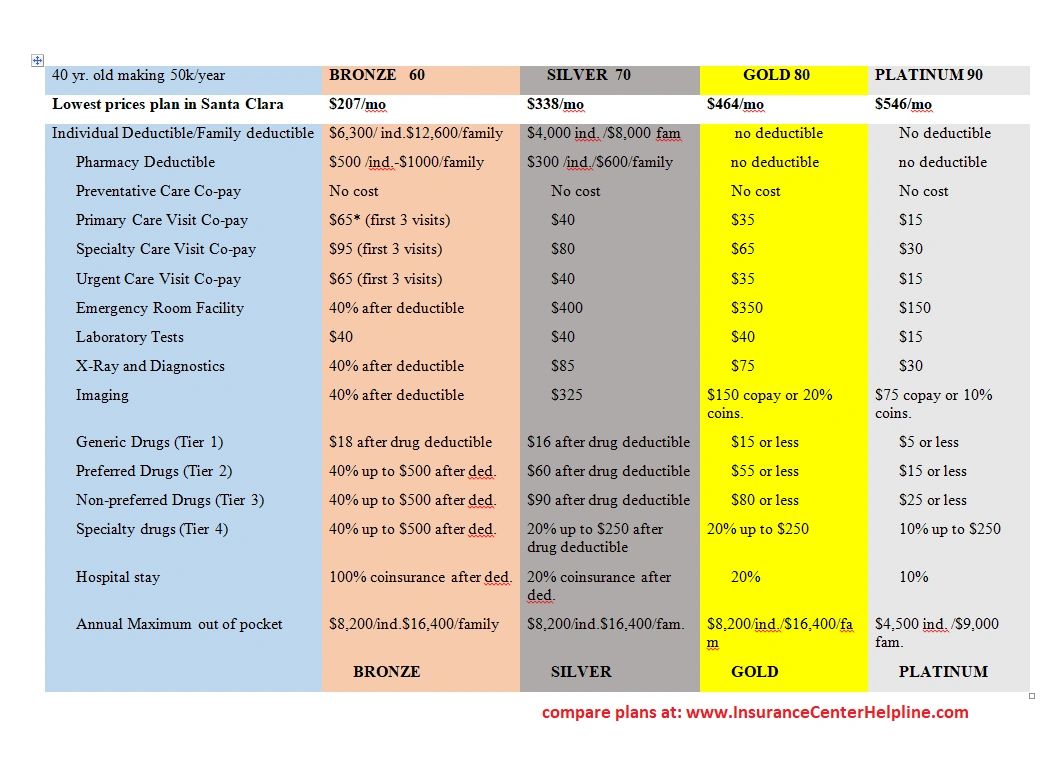

The world of insurance can often feel like an Olympic arena, with various policies competing for your attention and hard-earned money. When evaluating which policy offers the best value, it's crucial to look beyond the headline premiums and examine the coverage options, customer service ratings, and claims handling of each provider. Factors such as deductibles, co-pays, and overall coverage limits can greatly influence your out-of-pocket expenses over time. According to a study by J.D. Power, consumers who take the time to compare policies often find significant savings while ensuring they do not compromise on critical benefits.

One effective strategy for selecting the right insurance policy is to create a comparison chart that outlines key aspects such as premium costs, deductibles, and benefits. This will allow you to see how different options stack up against each other. Additionally, reading consumer reviews and consulting with an insurance broker can provide valuable insights into which policies truly deliver on their promises. Ultimately, a well-informed decision rooted in thorough research will guide you towards the policy that offers the best value for your specific needs, much like an athlete aiming for gold in their event.