Case Journeys

Exploring intriguing stories and insights from around the world.

Digital Asset Trading: Profit Like It's a Game of Chess

Master digital asset trading like a chess grandmaster! Unlock strategies to maximize profits and outsmart the market in every move.

Mastering Digital Asset Trading: Strategies That Turn Profits into Checkmate

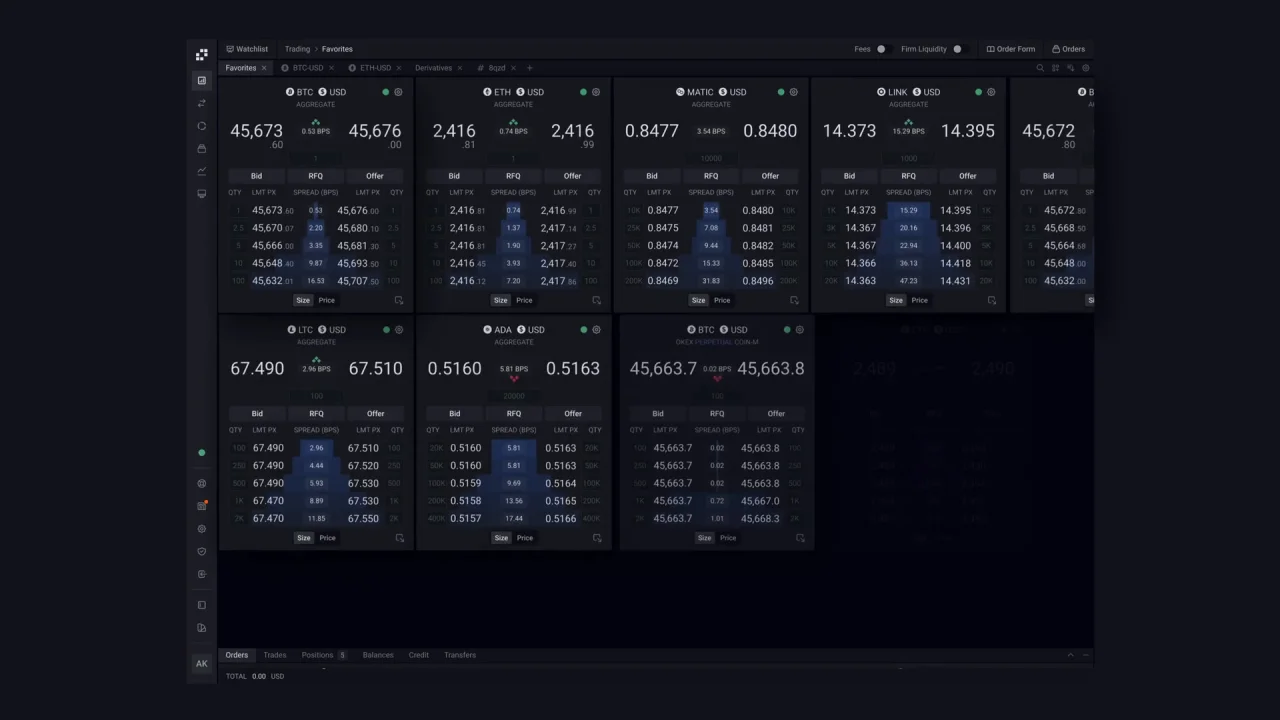

In the rapidly evolving landscape of digital asset trading, mastering digital asset trading requires a blend of strategic insight and market knowledge. To achieve success, traders must adopt a multifaceted approach, incorporating both technical and fundamental analysis. By utilizing tools such as technical indicators, risk management techniques, and an understanding of market sentiment, traders can develop strategies that increase their potential for consistent profitability. A well-crafted trading plan, which includes clear entry and exit points, can guide traders in making informed decisions, ultimately turning profits into a winning strategy.

Additionally, diversification is a crucial aspect of digital asset trading. Rather than putting all resources into a single asset, traders should consider spreading their investments across various digital currencies and platforms. This not only mitigates risk but also opens up opportunities for enhanced returns. Regularly reviewing and adjusting your trading strategies based on market trends and your performance metrics can create a dynamic approach that keeps you ahead of the competition. Implementing these strategies may not guarantee every trade will be a success, but over time, they can lead to a decisive checkmate in the world of digital asset trading.

Counter-Strike is a highly popular first-person shooter game that has captivated players since its release. With its team-based gameplay, players can engage in thrilling battles while employing strategy and skill. For those looking to enhance their gaming experience, using a daddyskins promo code can provide valuable in-game items and skins.

Is Digital Asset Trading the New Chess Game for Investors?

In recent years, digital asset trading has emerged as a dynamic form of investment akin to playing a complex game of chess. Just as chess requires strategic foresight, careful planning, and the ability to adapt to your opponent’s moves, investing in digital assets requires a keen understanding of market trends, technology, and investor psychology. The volatility of cryptocurrencies, NFTs, and other digital assets can mirror the unpredictable nature of a chess game, where each decision can either lead to a checkmate or result in your downfall. Investors today must cultivate a strong analytical mindset to navigate the digital landscape effectively.

The question arises: are investors unwittingly entering a new chess game with digital assets? Digital asset trading not only introduces complex scenarios but also offers opportunities for innovative strategies that can yield significant rewards. In this high-stakes environment, successful investors must think several moves ahead, anticipate market shifts, and make calculated risks. Just as chess players study their opponents, investors should stay informed about regulatory changes and emerging technologies to secure their edge in this evolving game of assets.

The Winning Moves: How to Outplay the Market in Digital Asset Trading

In today’s fast-paced world of digital asset trading, understanding the market dynamics is crucial for success. To truly outplay the market, traders must develop a strategic approach that involves thorough research and analysis. Here are key moves to consider:

- Educate Yourself: Stay informed about market trends and technologies.

- Utilize Analytical Tools: Use data analytics and charting software to identify patterns.

- Diversify Your Portfolio: Invest in a variety of assets to mitigate risks.

Moreover, mastering psychological resilience can significantly impact trading outcomes. Emotional control is essential; market fluctuations can evoke fear and greed, leading to impulsive decisions. Techniques such as setting clear goals and adhering to a trading plan can help maintain focus. Additionally, consider following successful traders and engaging in communities to share insights and strategies. By implementing these winning moves, you can develop a competitive edge in the ever-evolving digital asset landscape.