Case Journeys

Exploring intriguing stories and insights from around the world.

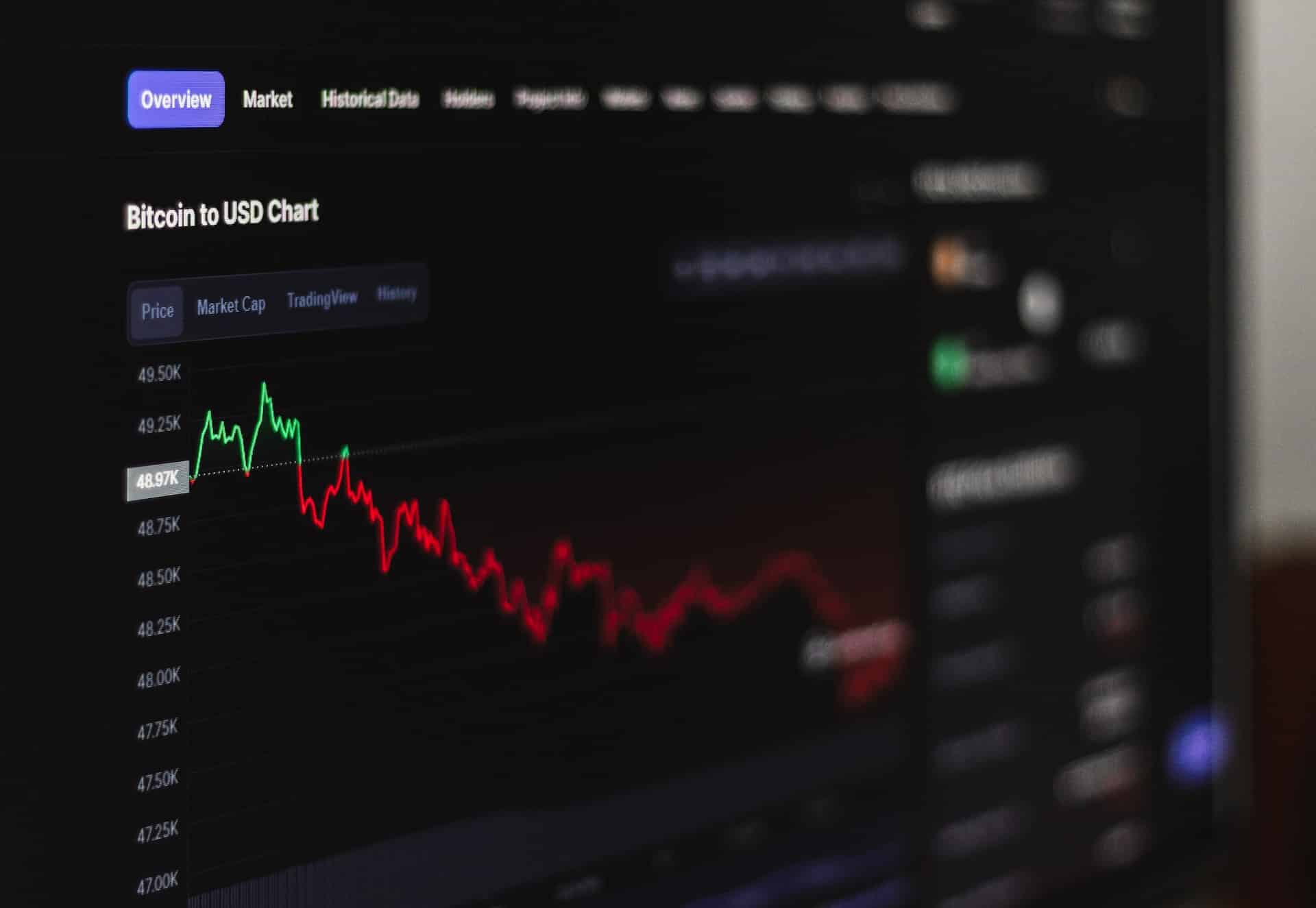

Earning in the Digital Wild West: Explore Market Arbitrage Opportunities

Unlock hidden profits in the digital wild west! Discover market arbitrage opportunities that can boost your earnings today!

Unlocking Profit Potential: A Beginner's Guide to Market Arbitrage

Market arbitrage is a strategy that savvy investors use to capitalize on price discrepancies across different markets. By purchasing an asset in one market and simultaneously selling it in another, traders can create a risk-free profit from the differences in prices. For beginners, it's essential to understand the profit potential that market arbitrage offers while also being aware of the challenges associated with it. Factors such as transaction fees, speed of execution, and market volatility can significantly impact profitability. Therefore, conducting thorough research and analysis is crucial before diving into this lucrative but complex field.

To embark on your market arbitrage journey, follow these key steps:

- Identify Opportunities: Look for price differences between various exchanges or markets.

- Setup Accounts: Ensure you have accounts on multiple platforms to facilitate quick trades.

- Monitor Market Conditions: Stay updated on market trends and news that could influence prices.

Counter-Strike is a popular first-person shooter game that has captivated millions of players worldwide. It emphasizes teamwork, strategy, and skill, making each match a unique experience. For those looking to enhance their gaming experience, you can check out the csgoroll promo code for exciting bonuses and rewards.

Navigating the Digital Landscape: Key Strategies for Successful Arbitrage

Navigating the Digital Landscape: Arbitrage involves capitalizing on market inefficiencies by buying and selling assets across different platforms or markets. To successfully leverage arbitrage opportunities, it’s crucial to analyze market trends continuously. One effective strategy is to utilize real-time data analytics tools that provide insights into price fluctuations and trading volumes. Additionally, staying updated with industry news and regulatory changes can help identify unexpected price movements that can be exploited for profit.

Another key strategy is developing a comprehensive risk management plan. Arbitrage trading, while often perceived as low-risk, can lead to significant losses in volatile markets. Consider employing automated trading systems that can execute trades at high speed and accuracy, reducing the window for potential loss. Moreover, diversifying your arbitrage strategies across various assets can help mitigate risks. Always remember, maintaining a clear exit strategy is vital to ensure that profits are locked in when conditions are favorable.

Is Market Arbitrage Worth Your Time? Pros, Cons, and Insights

Market arbitrage is the practice of taking advantage of price discrepancies across different markets or exchanges, allowing traders to profit from the inefficiencies inherent in these systems. Pros of market arbitrage include the potential for quick profits and the ability to leverage price differences without holding assets for extended periods. Moreover, as financial markets become increasingly interconnected, the opportunities for arbitrage are ever-present, potentially making it a feasible option for those willing to invest time in research and execution.

However, there are notable cons to consider. Engaging in market arbitrage often requires a deep understanding of market mechanics and rapid execution capabilities, which might not be accessible to all traders. Additionally, transaction costs and the risk of market fluctuations can eat into profits before they are realized. Thus, while market arbitrage can be rewarding, it is essential to weigh these factors carefully and evaluate whether the potential gains are worth the time and effort involved.